Like every year, the Launchworks & Co team was delighted to attend the Platform Strategy Summit, traditionally held at the MIT Media Labs in Boston. The event, organised by renowned platform academics Marshall Van Alstyne, Geoff Parker and Peter Evans, was held online for the second year in a row and brought together platform enthusiasts from around the world.

In this post, we summarise some of the key insights presented at the Platform Strategy Summit 2021.

Five platforms trends to watch after a year of upheaval

Peter Evans highlighted five key platform trends with short medium and long term implications:

- Increased deployment of platform business models by traditional and industrial firms;

- Integration of platform-to-platform capabilities creating even more powerful ecosystems;

- Addition of “experiences” to many platforms models;

- Platforms increasingly experimenting with Non Fungible Tokens (NFTs);

- The combination of platform services into “super apps”.

Peter discussed how an increasing number of industrial players are deploying platform business models within their organisations. For example Shell recently launched its Oren B2B marketplace for the mining sector in partnership with IBM. This is highly consistent with Launchworks & Co’s recent experience and we are seeing first-hand the increased interest of established firms in platform business models to supplement their existing capabilities.

Platform-to-platform integration is accelerating and is resulting in the emergence of new e-commerce ecosystems. Peter took the example of TikTok integrating with Shopify to enable merchants on Shopify to connect with relevant TikTok creators and communities for marketing and advertising purposes. This shows how vibrant the platform world is since TikTok, that was only launched four years ago, is now a global player with billions of users.

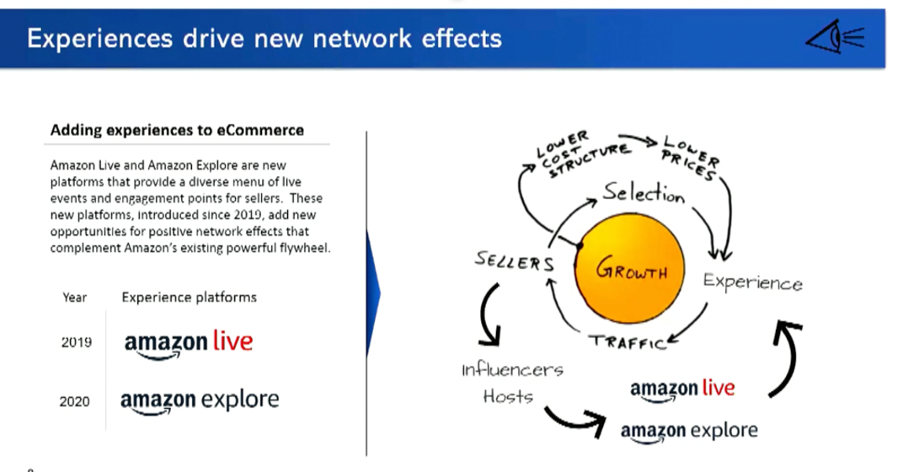

Further, Peter noted that mature platforms are starting to add ‘experience to their model to reinforce the network effects and stickiness of their existing ecosystem. He showed how Amazon is rapidly adding experiences with an e-commerce feature to its platform (Amazon Live and Amazon Explore – which focus on different products in different parts of the world than the existing platform) as ways of creating experiences for sellers and of complementing the fly wheel as a result.

Source: Peter Evans, MIT Platform Strategy

Peter also highlighted the increasing use of Non Fungible Tokens (NFTs) by a number of platforms. NFTs use blockchain technology to authenticate digital assets such as image files or videos. While the future of NFTs remain uncertain, they may become the ultimate collectibles for some.

Peter concluded his talk by mentioning the emergence of super apps (Grab, GoTo, Sea, etc.), particularly in Southeast Asia, where more and more services (ride sharing, food delivery, financial services, etc.) are bundled within the same app to create complete ecosystems. This brought the open question of whether such super apps could expand beyond Asia and become a global phenomenon.

Comparing and contrasting B2B and B2C platforms

In his presentation Geoff Parker highlighted how:

• B2B platforms differ from B2C in some important ways

• Fundamental economics of value creation help us understand different systems

• Technology initiatives to support digital transformation plans differ along dimensions of business model and operating model changes required and can be categorised by the number and type of actors involved

• Infrastructure investments can exhibit worse before better impacts

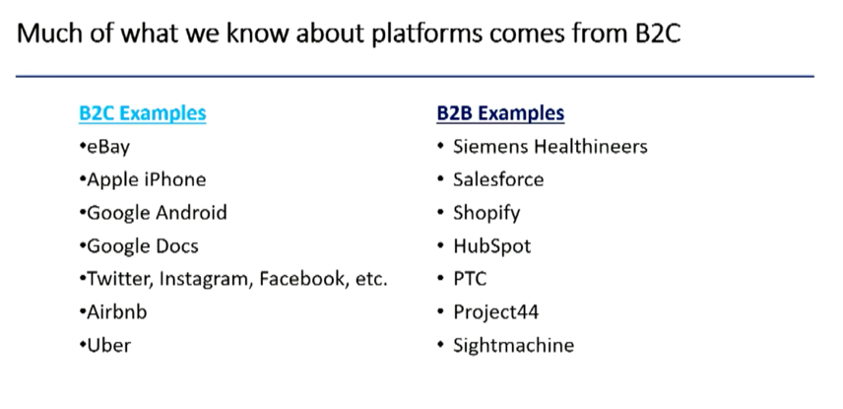

Geoff pointed out that most of what we know about platforms comes from B2C players, while B2B platforms differ in a number of important ways including: customer needs and sales cycles, pricing and cost sensitivity of participants, marketing mix, need for product knowledge, trust for transactions, importance of data ownership, interaction frequency…

Source: Geoff Parker, MIT Platform Strategy Summit

Interestingly Geoff highlighted that, as a result of these key differences, B2B platforms can be more complex and experience different challenges including around the governance and ownership of data. For example, large firms often have valuable assets and significant bargaining power when negotiating data provisions within platform ecosystems. Geoff also noted how important it was for firms to be clear about their value creation processes, be it same side or cross side network effects or the stand alone value of a core product.

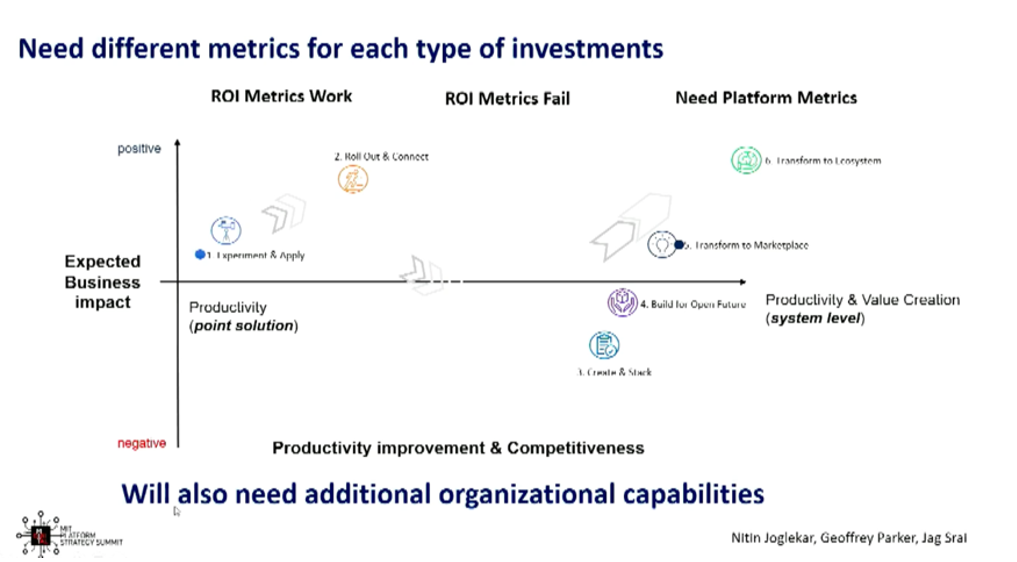

Geoff then presented some key results of a recent study he conducted with Nitin Joglekar and Jag Srai on digital transformation and the adoption of new technologies by established firms. The research project looks at the different types of digital transformation initiatives (Experiment and Apply, Roll-out and Connect, Create and Stack, Build for Open Future, Transform to marketplace, Transform to ecosystem) and their respective successes/challenges.

They conducted that while many manufacturing firms went for “point solutions” as part of their digital transformation journey and were able to make their operations more effective, a number of firms were able to truly transform their business and shift to platform ecosystems.

Geoff noted that this transition was particularly difficult since it required a shift in mindset and the use of different metrics/definitions of success depending on the type of digital transformation initiative. For example, if traditional metrics are well adapted to digital initiatives that increase productivity, initiatives focused on the development of sector wide platform ecosystems will require metrics tracking ‘ecosystem health’ and ‘contribution to and from third parties’. This means that firms need to accept the fact that transformative platform ecosystem initiatives often require initial investments before generating financial contributions.

The study also showed that firms that invested the most in digital infrastructure had the most flexibility to respond to the COVID crisis. Geoff highlighted the need for actors launching technology initiatives to have matching metrics for each type of initiative/investment, as they have different impacts on the organisation and its model.

Source: Geoff Parker, MIT Platform Strategy Summit

These findings are highly consistent with our experience and the use of the wrong metrics to assess platform projects is a typical issue for our clients. This is particularly the case for established firms developing their platform strategy, where the ‘rails’ of the core business and associated performance metrics often conflict with platform strategy initiatives that require ecosystem level management metrics and capabilities.

Regulation for platforms and forecast, the new kinds of data rights and the issue of valuing these networks

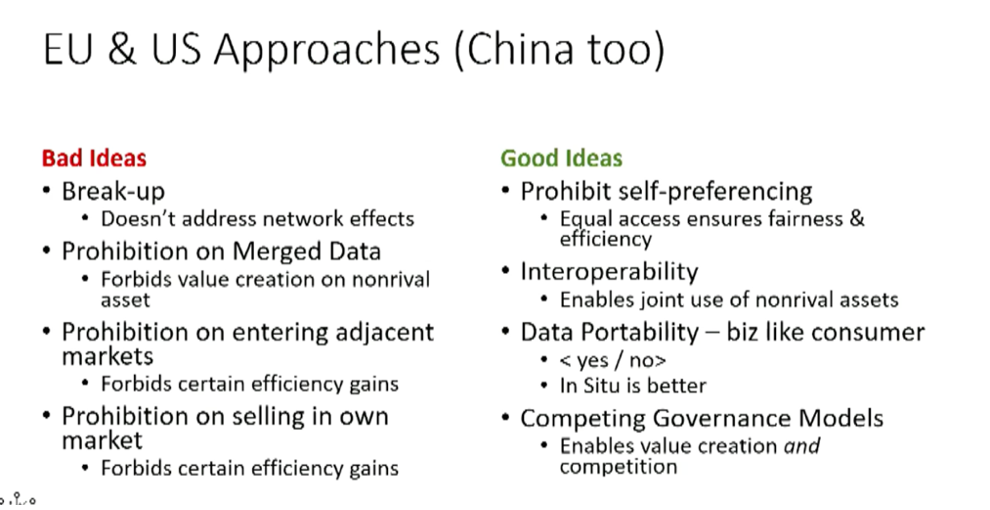

Marshall Van Alstyne discussed how regulatory pressure is going to intensify internationally for platforms, as approaches in the US, the EU and to a lesser extent China are aligning, and what different legislative options meant in terms of data rights and valuation of platforms.

He noted that the Biden administration has followed a framework first introduced at Standard Oil, with recent legislation preventing platforms from competing in their own markets and acquiring companies in adjacent markets. He argued that such approaches posed questions and raised potential issues (which he categorised) relating to data rights (remove friction for value creation vs privacy rights) and to the method of valuation for networks (i.e should we treat platforms as infrastructure).

Source: Marshall Van Alstyne, MIT Platform Strategy Summit

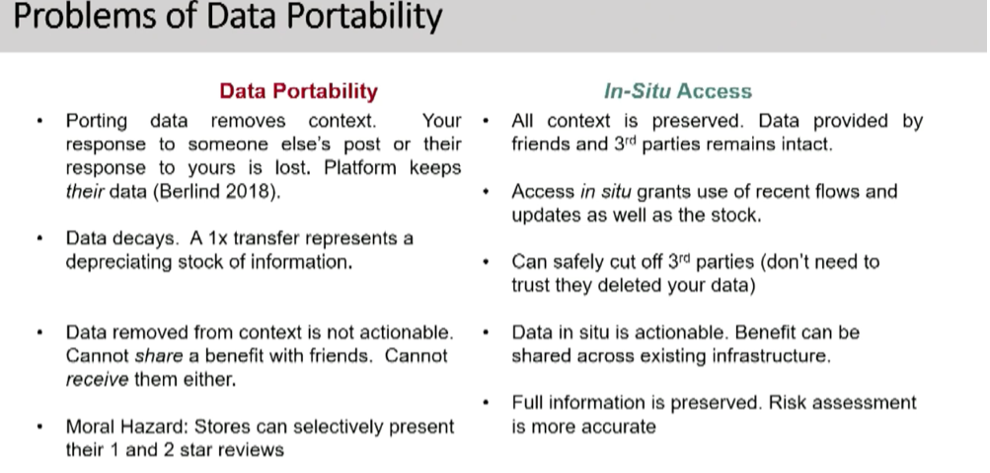

He also added that data portability could create problems and compared it to in situ access.

Source: Marshall Van Alstyne, MIT Platform Strategy Summit

Marshall’s insights into data regulations will no doubt contribute to shape the debate in the US and beyond. Regulators will need to develop new approaches to efficiently answer the unique challenges raised by platforms. We are following closely regulatory developments in Europe and believe that ongoing regulatory dialogue and high-level principles could be ways towards a constructive approach in which regulation does not necessarily lead to a zero-sum game outcome.